AVOID THE DEBT TRAP PAY OFF DEBT AND START SAVING

AVOID THE DEBT TRAP PAY OFF DEBT AND START SAVING sadmin

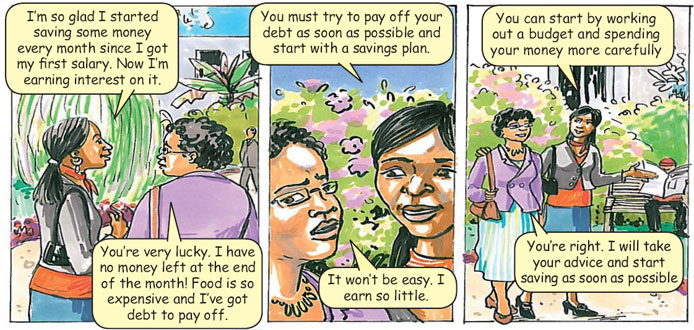

A lesson to be learned from the high cost of living is that we should try to be free of debt and to start saving our money.

If we have unpaid debt that we made years ago, the higher interest rates mean that we have to pay more interest on the debt. But for people who have been saving all along, the high interest rate means they can enjoy better returns on their savings.

Never too late

Even though times are tough, we shouldn't despair. The present economic situation can help us to start building for the future. It is a wake-up call to South Africans that debt should be paid up as quickly as possible and that it's never too late to start saving.

Even if you save just one rand a day instead of spending two rand then you would have saved money that day. The situation also forces many people to start looking more closely at how they spend their money. This means budgeting, saving and not spending more than you earn. It also means checking your credit profile at least twice a year

Credit status

In line with the National Credit Act, you do not have to pay to have your credit status checked for the first time in a year. But you have to pay about R20 to have it checked for the second time in the same year.

Once you find out that your credit profile is not good, you can take steps to improve it. For example, start paying off any bad debt that you still have and don't buy anything else on credit, especially not expensive items. Instead of buying on credit, rather use the money to pay off your debt.

In this way you will get a positive credit profile. It can help you if you really need to buy something in future when economic conditions are better and interest rates are lower.

Check your profile

It is also important to check your profile with the credit bureau. About six million South Africans are listed negatively so far. Checking your profile gives you a chance to make sure that you will not be blacklisted unfairly. If you find that you have been listed unfairly, you can take steps to have your name removed from the list.

It is important to build up a good credit profile as it may help you when you really need to buy a big item like a car or a house in future.

- Muzi Mkhwanazi