SURVIVING THE ECONOMIC SLOW-DOWN

SURVIVING THE ECONOMIC SLOW-DOWN sadmin

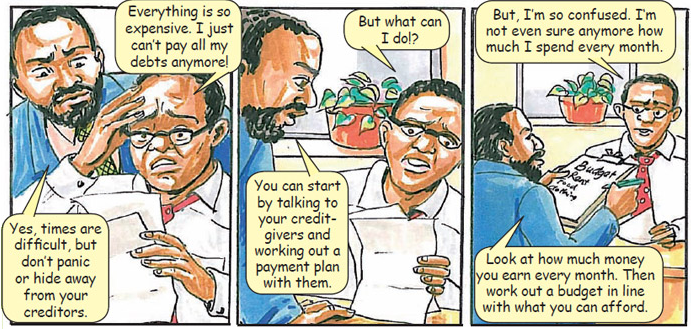

The economic slow-down is making it difficult for everyone to survive. Many things have become more expensive. People are struggling to pay off their debts and meet their basic needs. If you have fallen into the debt trap, you must not panic or hide away from your creditors. Accept that you have debt and make a plan to deal with it as soon as possible. Never take a loan to pay off another loan. This will just get you into more debt.

Tips to help you

- Don't ignore your debt

There are many factors that can prevent you from paying your debts. These include things like losing your job, the death of a family member, high interest rates and high food prices. But you must never ignore your debt.

If you lose your job, tell your credit-givers. Talk to them about a payment plan. Explain your situation and tell them what you can afford to pay off every month.

If you get a retrenchment package, use some of the money to pay off your debts. You have the right to settle your debts earlier than the agreed period.

- Budget and pay your debt

Draw up a budget in line with the money that comes into the household. You can also keep a spending diary - write down every cent you spend for the month. This will help you to see where you can cut down on your spending.

Stick to your budget and start paying off your debt, even if it's small amounts. This will be important in the future when you need a loan to buy a house or a car.

- Cut down your expenses

If you haven't got enough money to cover your expenses, see where you can cut down on your spending. Shop around for the best deals like special offers. Planning will help you a lot. Start by buying only what you really need.

- Start saving today

Plan to save every month. Putting money aside will help you in emergency situations like when you lose your job, have an accident or lose a family member. It is important to follow your savings plan. Cut out unnecessary expenses like cigarettes and alcohol or clothes and luxury items which you don't really need. Look out for bargains and buy in bulk once a month instead of buying small amounts every week.

- Don't buy on credit

Instead of buying on credit, save money until you can afford to pay cash.

- Carol Netshifhefhe

For more information, call the National Credit Regulator: 0860 627 627 Department of Trade and Industry: 0861 843 384 Financial Services Board: 0800 110 443